Benefits

Exercise greater control over Risk Management processes, Premium Investment and Claims Handling Practices.

It’s Yours For The Profit

By Deploying A Captive Insurance Company, Your Organization Has Taken The First Steps:

- Minimize Insurance costs

- Customize your coverage

- Stabilize your premiums

- Pre-fund Retained Risks

- Earn Potential Profits

As Large Account Specialists We Will:

- Talk with our clients and explain their options… as Large Accounts have many options.

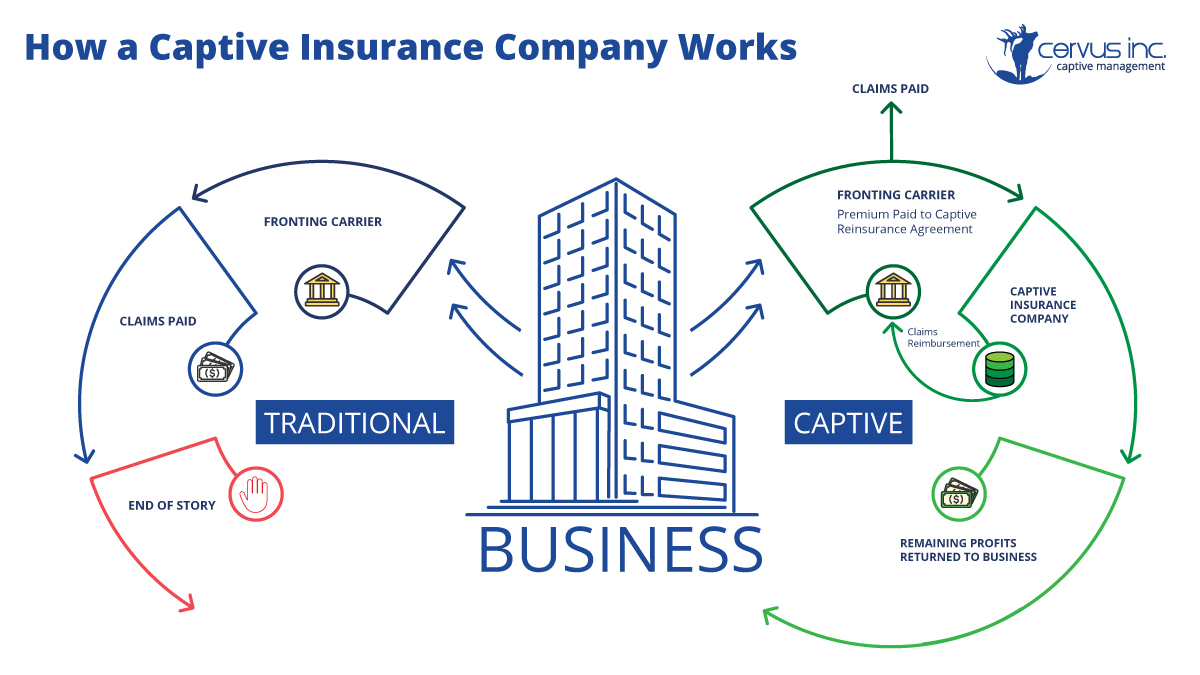

- Perform financial modeling to help clients determine if a captive insurance company achieves the goals they have in mind. Or is a Large Deductible plan a better option? What is the right Specific Retention? What is the Aggregate risk? What is the Loss Pick? Pre-fund or Letter of Credit? Tax implications? CERVUS has financial models that bring clarity to these and many other questions.

- Dig into the underwriting because we don’t feel we can give quality advice without a crystal-clear understanding of the historical exposures and claims. We explain our findings in language clients understand. We make underwriting information actionable for our clients.

- Prepare detailed reinsurance submissions that include a complete underwriting work-up, actuarial review

and pro-forma . - Seek and Qualify Fronting Arrangements

- Negotiate with claims services providers.

For Clients This Means:

- Turning insurance expense into insurance profit

- Lower insurance costs and greater control over their coverage and risks

- An open door to a variety of national and international reinsurers

- The ability to

insure unusual or difficult risks - Earning underwriting profits and investment income

157 Chalburn Road

Vestal, NY 13850

607.296.4503